You’re all packed, passport in hand, dreaming of street food and neon lights in Seoul… but what about money?

Can you swipe your American credit or debit card everywhere? Do you need to carry cash? Is it easy to find an ATM and grab cash?

South Korea is incredibly modern, but travelers who aren’t sure how to pay as tourists can still encounter frustrating payment issues.

This guide will save you from awkward card declines, unexpected fees, and those “uhhh… do you take cash?” moments.

Here’s what you need to know about using cards and cash in Korea, plus how to avoid the common mistakes tourists make.

This post is based on personal travel experience and is for informational purposes only. I’m not a financial advisor. Always check with your bank about international fees and card policies before you travel.

Quick Take — Should You Use Cash or Card in Korea?

Here’s the simple breakdown:

- Credit Cards: Work at hotels, chain stores, and convenience stores.

- Debit Cards: Same as credit cards, but you’ll need Global ATMs to withdraw funds. Daily withdrawal limit is usually ₩300,000–₩700,000.

- Cash: Essential for street markets, small shops, some taxis outside major cities, and topping off your T-Money card.

Pro Tip: Always carry at least ₩100,000–₩200,000 in Korean Won. You don’t want to get stuck at a food stall with no cash and a sad, empty stomach.

Why You Need to Read This Guide

You’ll find tons of financial blogs telling you which travel credit card to get. That’s not what this post is about.

This guide is for travelers heading to Korea soon (or already there) wondering: “Will my card work? Do I need cash? Which ATM should I use?”

As someone who’s been to South Korea multiple times, I’ve experienced my card not working at smaller shops and restaurants.

So, I always carry an additional card as well as cash. Let’s make sure that you are prepared in case this happens to you!

Common Payment Pitfalls (And How to Avoid Them)

Your Card Doesn’t Work at the Register

Even in a high-tech country like South Korea, your credit or debit card might randomly stop working at the register. But it’s not always clear why.

Small shops, street vendors, and older payment machines are often set up to accept only Korean-issued cards.

Foreign cards, especially debit cards, are often rejected at mom-and-pop restaurants, market stalls, and small shops located outside the city

It’s frustrating but common. That’s why carrying cash and a backup card is a smart move.

ATMs Rejecting Your Card

One of the most common frustrations travelers face in South Korea is finding an ATM that accepts foreign cards. Not every machine will work.

Look specifically for ATMs marked with a Global ATM logo.

Stick to ATMs inside major banks like KEB Hana, Shinhan, or KB Kookmin, or at 7-Eleven convenience stores.

Please note that machines have a daily withdrawal limit of ₩300,000; however, some bank ATMs may allow up to ₩700,000.

This has nothing to do with your card. It’s just how Korea works.

Pro Tip: If you’re American, the Charles Schwab debit card is a game-changer. No foreign ATM fees, and it works like a charm in Korea. This is what I use on my trips to South Korea.

The KRW vs. USD Payment Prompt

When making larger purchases, the cashier may ask whether you prefer to pay in KRW (Korean Won) or USD.

It might seem tempting to choose USD since it’s familiar, but you’ll usually encounter unfavorable conversion rates and additional fees

You’re almost always better off choosing KRW and letting your bank handle the exchange rate.

The only exception is if your bank offers explicitly better rates for USD transactions abroad. It’s worth checking before your trip.

Need KTX Train Tickets? 👉 Book your tickets here to reserve your seat in advance with Trip.com.

Should You Get a Tourist Payment Card (WOWPASS, Namane)?

While researching your trip to Korea, you’ve probably come across tourist payment cards like WOWPASS and Namane.

These sound like an easy solution, but for most American travelers, they’re usually not worth the hassle.

These cards require you to download an app to manage your balance, but you still have to top off the T-Money portion with cash at kiosks or convenience stores.

You can’t withdraw money from ATMs using these cards, either. You’ll need to use product-specific kiosks, which you can find at subway stations or hotels.

If you’re curious, check the official WOWPASS website or Namane card site for more details.

Through my research, I would not recommend these cards unless for some reason you can’t get a travel credit or debit card before your trip.

When You’ll Need Cash in Korea

Even in high-tech South Korea, there are still plenty of places where cash is king.

You’ll definitely need Korean Won for:

- Street food and traditional markets

- Taxis outside of Seoul

- Small, family-run restaurants (especially in rural areas)

- Topping off your T-Money card

Many vendors may have card readers, but foreign cards often don’t work. Locals usually just transfer money via bank apps.

Avoid the awkward situation and just pay in cash.

Where Credit and Debit Cards Work in Korea

The good news is that South Korea is one of the most card-friendly countries in Asia, especially in the big cities.

You can use your credit or debit card at pretty much any hotel, major accommodation, or chain store without any issues.

You can use your credit or debit card at:

- Hotels and major accommodations

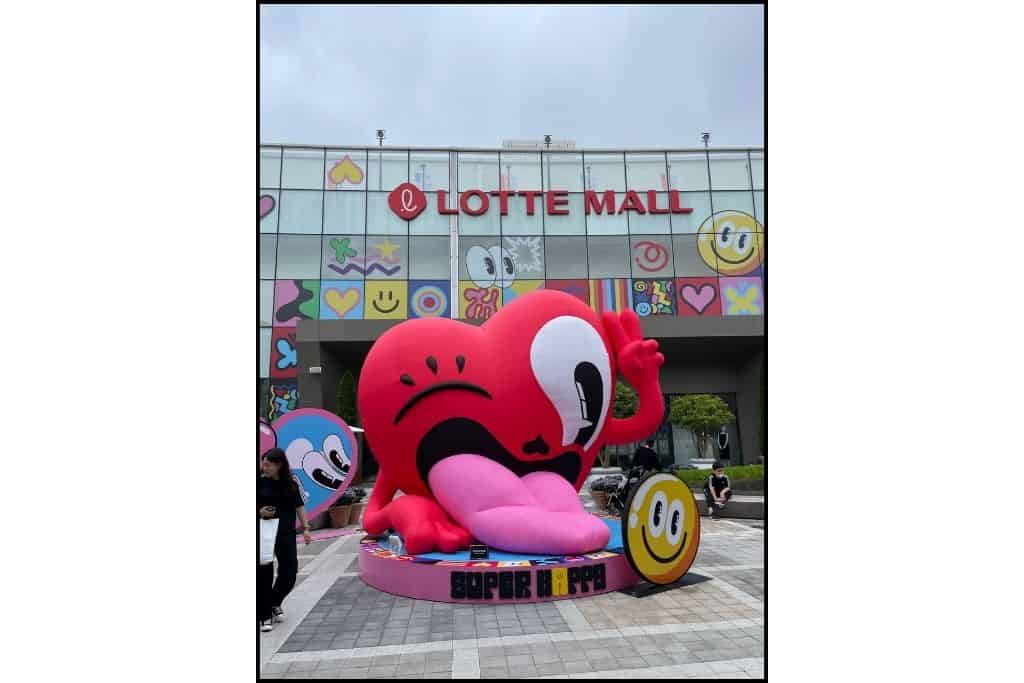

- Chain stores and department stores

- Convenience stores (GS25, CU, 7-Eleven)

- Most restaurants and cafés in tourist areas

- Shopping malls and airports

A good rule of thumb: If the place looks shiny, corporate, or packed with tourists, your card will probably work just fine.

Important note: Don’t assume Apple Pay is accepted everywhere. Despite what some folks claim online, you can’t rely on it for your entire trip.

Pro Tips for Spending Money in Korea

Before hopping on that plane, set yourself up for success:

Download your bank’s mobile app if this is a new card. Get familiar with checking balances and transferring funds—you’ll thank yourself later.

Test your cards at home with a small purchase. Make sure they’re ready to go.

Bring at least two cards: one credit, one debit. Having a backup saves the day when one gets flagged.

Contact your bank before traveling. Let them know you’ll be in South Korea to prevent fraud alerts that freeze your card mid-trip. Ask about international fees while you’re at it.

Keep ₩100,000–₩200,000 in cash for cash-only spots or card failures.

Staying connected in Korea is a lot easier with a SIM card or eSim

👉 Grab your SKT Unlimited Local Data & Voice Calls Sim Airport Pick up HERE

OR

Grab your Korea eSIM with SKT Unlimited LTE data + Voice

Grab a T-Money card as soon as you arrive. There’s a convenience store at the airport where you can buy and load one with cash.

It makes riding subways and buses way easier, and buses don’t accept cash anyway.

The T-Money card costs maybe ₩5,000 and pays for itself immediately.

I’ve met folks who buy single-ride tickets every time, and I’m honestly confused why anyone would do that to themselves.

FAQ About Money & Payments in Korea

Yes, most American credit cards work at major stores, hotels, restaurants, and convenience stores. However, small shops, street markets, and some kiosks may not accept foreign credit cards, so it’s always a good idea to carry cash.

For most American travelers, no. These prepaid cards can be confusing, require an app for loading, and might be sold out at kiosks. You can’t use regular ATMs. Instead, you’ll need to use product-specific kiosks located in specific areas. Using your US credit/debit card, plus cash, is usually easier.

You might see posts claiming WOWPASS offers a “better” exchange rate, like 1,435 KRW to 1 USD instead of 1,457 KRW. Here’s the real math: That’s only about ₩22 per dollar, or roughly 1.5 cents USD per $1. If you exchange $100, you’ll save around $1.50 total. And that’s before considering fees, machine limits, or restrictions. It’s not the money-saving hack it’s hyped up to be.

Check the official WOWPASS website or Namane card site for more details.

Yes! Many places still prefer cash, especially small restaurants and shops outside big cities. You’ll want at least ₩100,000–₩200,000 in your wallet for street food, taxis, markets, and emergencies.

Only at Global ATMs. Look for them inside major banks, airports, and 7-Eleven stores. Daily withdrawal limits are usually ₩300,000–₩700,000.

0.

Final Thoughts

South Korea is one of the most card-friendly countries in the world, but that doesn’t mean you can swipe worry-free everywhere.

Between the cash-only food stalls, card machine quirks, and ATM issues, it pays to be prepared.

Save yourself the stress. Carry cash, bring a good travel card, and get a T-Money card as soon as you arrive.

You’ll spend less time figuring out how to pay and more time eating tteokbokki and snapping selfies at Gyeongbokgung Palace.

Plan Your South Korea Trip Like a Pro!

Now that you know how to avoid money mistakes in Korea, here are more guides to make your trip smoother: